创建自己的小题库

搜索

【单选题】

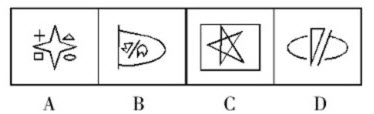

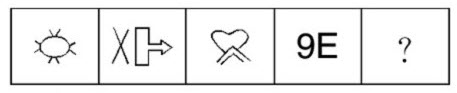

“浓” 对于 ( ) 相当于 “否”(音同“丕”) 对于 ( )

A.

清,是

B.

淡,泰

C.

稀,定

D.

疏,是

分享

分享

反馈

反馈 收藏

收藏 举报

举报参考答案:

举一反三

【单选题】在我国民间常用十二生肖进行纪年,十二生肖的排列顺序是鼠、牛、虎、兔、龙、蛇、马、羊、猴、鸡、狗、猪。2011年是兔年,那么2050年是( )。

A.

虎年

B.

龙年

C.

马年

D.

狗年

【单选题】What can we conclude from the conversation()

A.

Comprehensive schools do not offer quality education.

B.

Parents decide what schools their children are to attend.

C.

Public schools are usually bigger in size than private schools.

D.

Children from low income families can’t really choose schools.

【单选题】Rates are low, but consumers won’t borrow The US What does the author say about lenders in the current credit market() A.They are becoming more cautious. B.They are eager to offer more loans. C.They a...

A.

Rates are low, but consumers won’t borrow The US

B.

Federal Reserve(Fed)'s announcement last week that it intended to keep credit cheap for at least two more years was a clear invitation to Americans: Go out and borrow.

C.

But many economists say it will take more than low interest rates to persuade consumers to take on more debt. There are already signs that the recent stock market fluctuations, turbulence in Europe and the US deficit have scared consumers. On Friday, preliminary data showed that the Thomson Reuters/University of Michigan consumer sentiment index had fallen this month to lower than it was in November 2008, when the United States was deep in recession.

D.

Under normal circumstances, the Fed's announcement might have attracted new home and car buyers and prompted credit card holders to rack up fresh charges. But with unemployment high and those with jobs worried about keeping them, consumers are more concerned about paying off the loans they already have than adding more debt. And by showing its hand for the next two years, the Fed may have thoughtlessly invited prospective borrowers to put off large purchases.

E.

Lenders, meanwhile, are still dealing with the effects of the boom-gone-bust and are forcing prospective borrowers to go to extraordinary lengths to prove their creditworthiness. "I don't think lenders are going to be interested in extending a lot of debt in this environment," said Mark Zandi, chief economist of Moody's Analytics, a macroeconomic consulting firm. "Nor do I think households are going to be interested in taking on a lot of debt."

F.

In housing, consumers have already shown a slow response to low rates. Applications for new mortgages have decreased this year to a 10-year low, according to the Mortgage Bankers Association. Sales of furniture and furnishings remain 22% below their pre-recession peak, according to Spending Pulse, a research report by MasterCard Advisors.

G.

Credit card rates have actually gone up slightly in the past year. The one bright spot in lending is the number of auto loans, which is up from last year. But some economists say that confidence among car buyers is hitting new lows.

H.

For Xavier Walter, a former mortgage banker who with his wife, Danielle, accumulated$20 000 in credit card debt, low rates will not change his spending habits.

I.

As the housing market topped out five years ago, he lost his six-figure income. He and his wife were able to modify the mortgage on their four-bedroom house in Medford, New Jersey, as well as negotiate lower credit card payments.

J.

Two years ago, Mr. Walter, a 34-year-old father of three, started an energy business. He has sworn off credit. "I'm not going to go back in debt ever again," he said. "If I can't pay for it in cash, I don't want it."

.

Until now, one of the biggest restraints on consumer spending has been a debt aftereffect. Since August 2008, when household debt peaked at$12.41 trillion, it has declined by about$1.2 trillion, according to an analysis by Moody's Analytics of data from the Federal Reserve and Equifax, the credit agency. A large portion of that, though, was simply written off by lenders as borrowers defaulted on loans.

K.

By other measures, households have improved their position. The proportion of after-tax income that households spend to remain current on loan payments has fallen.

L.

Still, household debt remains high. That presents a paradox: many economists argue that the economy cannot achieve true health until debt levels decline. But credit, made attractive by low rates, is a time-tested way to increase consumer spending.

M.

With new risks of another downturn, economists worry that it will take years for debt to return to manageable levels. If the economy contracts again, said George Magnus, senior adviser at UBS, then "you could find a lot of households in a debt trap which they probably can never get out of."

N.

Mortgage lenders, meanwhile, burned by the housing crash, are extra careful about approving new loans. In June, for instance, Fannie Mae, the largest mortgage buyer in the United States, said that borrowers whose existing debt exceeded 45 to 50% of their income would be required to have stronger "compensating" factors, which might include higher savings.

.

Even those borrowers in strong financial positions are asked to provide unusual amounts of paperwork. Bobby and Katie Smith have an extremely good credit record, tiny student debt and a combined six-figure income. For part of their down payment, they planned to use about$5 000 they had received as wedding gifts in February.

.

But the lender would not accept that money unless the Smiths provided a certified letter from each of 14 guests, stating that the money was a gift, rather than a loan.

.

"We laughed for a good 15 or 20 minutes." recalled Mr. Smith. 34.

.

Mr. Smith, a program director for a radio station in Orlando, Florida, said they ended up using other savings for their down payment to buy a$300 000 four-bedroom house in April.

.

For those not as creditworthy as the Smiths, low rates are irrelevant because they no longer qualify for mortgages. That leaves the eligible pool of loan applicants wealthier, "older and whiter," said Guy Cecala, publisher of Inside Mortgage Finance. "It's creating much more of a divide," he said, "between the haves and the have-nots."

.

Car shoppers with the highest credit ratings can also get loans more easily, and at lower rates, said Paul C. Taylor, chief economist of the National Automobile Dealers Association

.

During the recession, inability to obtain credit severely cut auto buying as lenders rejected even those with good credit ratings. Now automakers are increasing their subprime(次级债的)lending again as well, but remain hesitant to approve large numbers of risky customers.

.

The number of new auto loans was up by l6% in the second quarter compared with the previous year, said Melinda Zabritski, director of automotive credit at Experian, the information services company.

.

But some economists warn that consumer confidence is falling. According to CNW Marketing Research, confidence among those who intend to buy a car this year is at its lowest since it began collecting data on this measure in 2000.

.

On credit cards, rates have actually inched higher this year. largely because of new rules that curb the issuer's ability to charge fees or raise certain interest rates at will.

.

At the end of the second quarter, rates averaged 14. 01% on new card offers, up from 13. 75% a year earlier, according to Mail Monitor, which tracks credit cards for Synovate, a market research firm. According to data from the Federal Reserve, total outstanding debt on revolving credit cards was down by 4. 6% during the first half of the year compared with the same period a year earlier.

.

Even if the Fed's announcement helps keep rates steady. or pushes them down, businesses do not expect customers to suddenly charge up a storm.

.

"It's not like, 'Oh, credit is so cheap. let's go back to the heydays(鼎盛时期),",said Elizabeth Crowell, who owns Sterling Place, two high-end home furnishing and gift stores in New York. "People still fear for their jobs. So I think where maybe after other recessions they might return to previous spending habits, the pendulum hasn't swung back the same way."

【单选题】本例右侧附件区囊性肿物最可能是()。 A.卵巢滤泡囊肿 B.卵巢黄体囊肿 C.卵巢内膜异位囊肿 D.输卵管卵巢囊肿 E.多囊卵巢综合征

A.

28岁不孕妇女,痛经3年且逐渐加重。查子宫后壁有2个触痛性硬韧结节,右侧附件区扪及超鸭卵大、活动不良囊性肿物,压痛不明显

【单选题】甲乙丙三朋友去参观车展,看到一款轿车。甲说:“这不是‘奇瑞’,也不是‘荣威’。” 乙说:“这不是‘奇瑞’,而是‘红旗’。”丙说:“这不是‘红旗’,而是‘奇瑞’。”后来, 车展管理员说:“三人中,有一个人的两个判断对;另一个人的两个判断都错;第三个人的两个判断一对一错。”由此可知( )。

A.

这辆轿车是奇瑞轿车

B.

这辆轿车是荣威轿车

C.

这辆轿车是红旗轿车

D.

上面三辆轿车都不是

【单选题】非对称信息,是指某些行为人拥有另一些行为人不拥有的信息。 根据上述定义,下列属于非对称信息的是( )。

A.

某企业发布信息招聘一名部门经理,要求男性、年龄不超过30岁,经考核面试合格后录用。应聘者甲、乙一路过关进入最后一轮筛选,在决定谁最后胜出时,乙被告知,因其不是本市户口,所以不予录用

B.

某单位在春节后上班第一天召开大会,规定职工上班时间不得玩游戏。一个月后,小李违规受到处理。小李争辩说,单位以前有过要求,以后再未提出类似要求

C.

某市在本市各大媒体上发布招录50名公务员消息,张某说他最近一直在外地,不知道这个消息,所以错过了报名时间

D.

某电视购物频道联手建材商家进行团购促销宣传,小李说他不知道

相关题目:

【单选题】在我国民间常用十二生肖进行纪年,十二生肖的排列顺序是鼠、牛、虎、兔、龙、蛇、马、羊、猴、鸡、狗、猪。2011年是兔年,那么2050年是( )。

A.

虎年

B.

龙年

C.

马年

D.

狗年

【单选题】What can we conclude from the conversation()

A.

Comprehensive schools do not offer quality education.

B.

Parents decide what schools their children are to attend.

C.

Public schools are usually bigger in size than private schools.

D.

Children from low income families can’t really choose schools.

【单选题】Rates are low, but consumers won’t borrow The US What does the author say about lenders in the current credit market() A.They are becoming more cautious. B.They are eager to offer more loans. C.They a...

A.

Rates are low, but consumers won’t borrow The US

B.

Federal Reserve(Fed)'s announcement last week that it intended to keep credit cheap for at least two more years was a clear invitation to Americans: Go out and borrow.

C.

But many economists say it will take more than low interest rates to persuade consumers to take on more debt. There are already signs that the recent stock market fluctuations, turbulence in Europe and the US deficit have scared consumers. On Friday, preliminary data showed that the Thomson Reuters/University of Michigan consumer sentiment index had fallen this month to lower than it was in November 2008, when the United States was deep in recession.

D.

Under normal circumstances, the Fed's announcement might have attracted new home and car buyers and prompted credit card holders to rack up fresh charges. But with unemployment high and those with jobs worried about keeping them, consumers are more concerned about paying off the loans they already have than adding more debt. And by showing its hand for the next two years, the Fed may have thoughtlessly invited prospective borrowers to put off large purchases.

E.

Lenders, meanwhile, are still dealing with the effects of the boom-gone-bust and are forcing prospective borrowers to go to extraordinary lengths to prove their creditworthiness. "I don't think lenders are going to be interested in extending a lot of debt in this environment," said Mark Zandi, chief economist of Moody's Analytics, a macroeconomic consulting firm. "Nor do I think households are going to be interested in taking on a lot of debt."

F.

In housing, consumers have already shown a slow response to low rates. Applications for new mortgages have decreased this year to a 10-year low, according to the Mortgage Bankers Association. Sales of furniture and furnishings remain 22% below their pre-recession peak, according to Spending Pulse, a research report by MasterCard Advisors.

G.

Credit card rates have actually gone up slightly in the past year. The one bright spot in lending is the number of auto loans, which is up from last year. But some economists say that confidence among car buyers is hitting new lows.

H.

For Xavier Walter, a former mortgage banker who with his wife, Danielle, accumulated$20 000 in credit card debt, low rates will not change his spending habits.

I.

As the housing market topped out five years ago, he lost his six-figure income. He and his wife were able to modify the mortgage on their four-bedroom house in Medford, New Jersey, as well as negotiate lower credit card payments.

J.

Two years ago, Mr. Walter, a 34-year-old father of three, started an energy business. He has sworn off credit. "I'm not going to go back in debt ever again," he said. "If I can't pay for it in cash, I don't want it."

.

Until now, one of the biggest restraints on consumer spending has been a debt aftereffect. Since August 2008, when household debt peaked at$12.41 trillion, it has declined by about$1.2 trillion, according to an analysis by Moody's Analytics of data from the Federal Reserve and Equifax, the credit agency. A large portion of that, though, was simply written off by lenders as borrowers defaulted on loans.

K.

By other measures, households have improved their position. The proportion of after-tax income that households spend to remain current on loan payments has fallen.

L.

Still, household debt remains high. That presents a paradox: many economists argue that the economy cannot achieve true health until debt levels decline. But credit, made attractive by low rates, is a time-tested way to increase consumer spending.

M.

With new risks of another downturn, economists worry that it will take years for debt to return to manageable levels. If the economy contracts again, said George Magnus, senior adviser at UBS, then "you could find a lot of households in a debt trap which they probably can never get out of."

N.

Mortgage lenders, meanwhile, burned by the housing crash, are extra careful about approving new loans. In June, for instance, Fannie Mae, the largest mortgage buyer in the United States, said that borrowers whose existing debt exceeded 45 to 50% of their income would be required to have stronger "compensating" factors, which might include higher savings.

.

Even those borrowers in strong financial positions are asked to provide unusual amounts of paperwork. Bobby and Katie Smith have an extremely good credit record, tiny student debt and a combined six-figure income. For part of their down payment, they planned to use about$5 000 they had received as wedding gifts in February.

.

But the lender would not accept that money unless the Smiths provided a certified letter from each of 14 guests, stating that the money was a gift, rather than a loan.

.

"We laughed for a good 15 or 20 minutes." recalled Mr. Smith. 34.

.

Mr. Smith, a program director for a radio station in Orlando, Florida, said they ended up using other savings for their down payment to buy a$300 000 four-bedroom house in April.

.

For those not as creditworthy as the Smiths, low rates are irrelevant because they no longer qualify for mortgages. That leaves the eligible pool of loan applicants wealthier, "older and whiter," said Guy Cecala, publisher of Inside Mortgage Finance. "It's creating much more of a divide," he said, "between the haves and the have-nots."

.

Car shoppers with the highest credit ratings can also get loans more easily, and at lower rates, said Paul C. Taylor, chief economist of the National Automobile Dealers Association

.

During the recession, inability to obtain credit severely cut auto buying as lenders rejected even those with good credit ratings. Now automakers are increasing their subprime(次级债的)lending again as well, but remain hesitant to approve large numbers of risky customers.

.

The number of new auto loans was up by l6% in the second quarter compared with the previous year, said Melinda Zabritski, director of automotive credit at Experian, the information services company.

.

But some economists warn that consumer confidence is falling. According to CNW Marketing Research, confidence among those who intend to buy a car this year is at its lowest since it began collecting data on this measure in 2000.

.

On credit cards, rates have actually inched higher this year. largely because of new rules that curb the issuer's ability to charge fees or raise certain interest rates at will.

.

At the end of the second quarter, rates averaged 14. 01% on new card offers, up from 13. 75% a year earlier, according to Mail Monitor, which tracks credit cards for Synovate, a market research firm. According to data from the Federal Reserve, total outstanding debt on revolving credit cards was down by 4. 6% during the first half of the year compared with the same period a year earlier.

.

Even if the Fed's announcement helps keep rates steady. or pushes them down, businesses do not expect customers to suddenly charge up a storm.

.

"It's not like, 'Oh, credit is so cheap. let's go back to the heydays(鼎盛时期),",said Elizabeth Crowell, who owns Sterling Place, two high-end home furnishing and gift stores in New York. "People still fear for their jobs. So I think where maybe after other recessions they might return to previous spending habits, the pendulum hasn't swung back the same way."

【单选题】本例右侧附件区囊性肿物最可能是()。 A.卵巢滤泡囊肿 B.卵巢黄体囊肿 C.卵巢内膜异位囊肿 D.输卵管卵巢囊肿 E.多囊卵巢综合征

A.

28岁不孕妇女,痛经3年且逐渐加重。查子宫后壁有2个触痛性硬韧结节,右侧附件区扪及超鸭卵大、活动不良囊性肿物,压痛不明显

【单选题】甲乙丙三朋友去参观车展,看到一款轿车。甲说:“这不是‘奇瑞’,也不是‘荣威’。” 乙说:“这不是‘奇瑞’,而是‘红旗’。”丙说:“这不是‘红旗’,而是‘奇瑞’。”后来, 车展管理员说:“三人中,有一个人的两个判断对;另一个人的两个判断都错;第三个人的两个判断一对一错。”由此可知( )。

A.

这辆轿车是奇瑞轿车

B.

这辆轿车是荣威轿车

C.

这辆轿车是红旗轿车

D.

上面三辆轿车都不是

【单选题】非对称信息,是指某些行为人拥有另一些行为人不拥有的信息。 根据上述定义,下列属于非对称信息的是( )。

A.

某企业发布信息招聘一名部门经理,要求男性、年龄不超过30岁,经考核面试合格后录用。应聘者甲、乙一路过关进入最后一轮筛选,在决定谁最后胜出时,乙被告知,因其不是本市户口,所以不予录用

B.

某单位在春节后上班第一天召开大会,规定职工上班时间不得玩游戏。一个月后,小李违规受到处理。小李争辩说,单位以前有过要求,以后再未提出类似要求

C.

某市在本市各大媒体上发布招录50名公务员消息,张某说他最近一直在外地,不知道这个消息,所以错过了报名时间

D.

某电视购物频道联手建材商家进行团购促销宣传,小李说他不知道

参考解析:

AI解析

重新生成

题目纠错 0

发布

复制链接

复制链接 新浪微博

新浪微博 分享QQ

分享QQ 微信扫一扫

微信扫一扫 ()

()